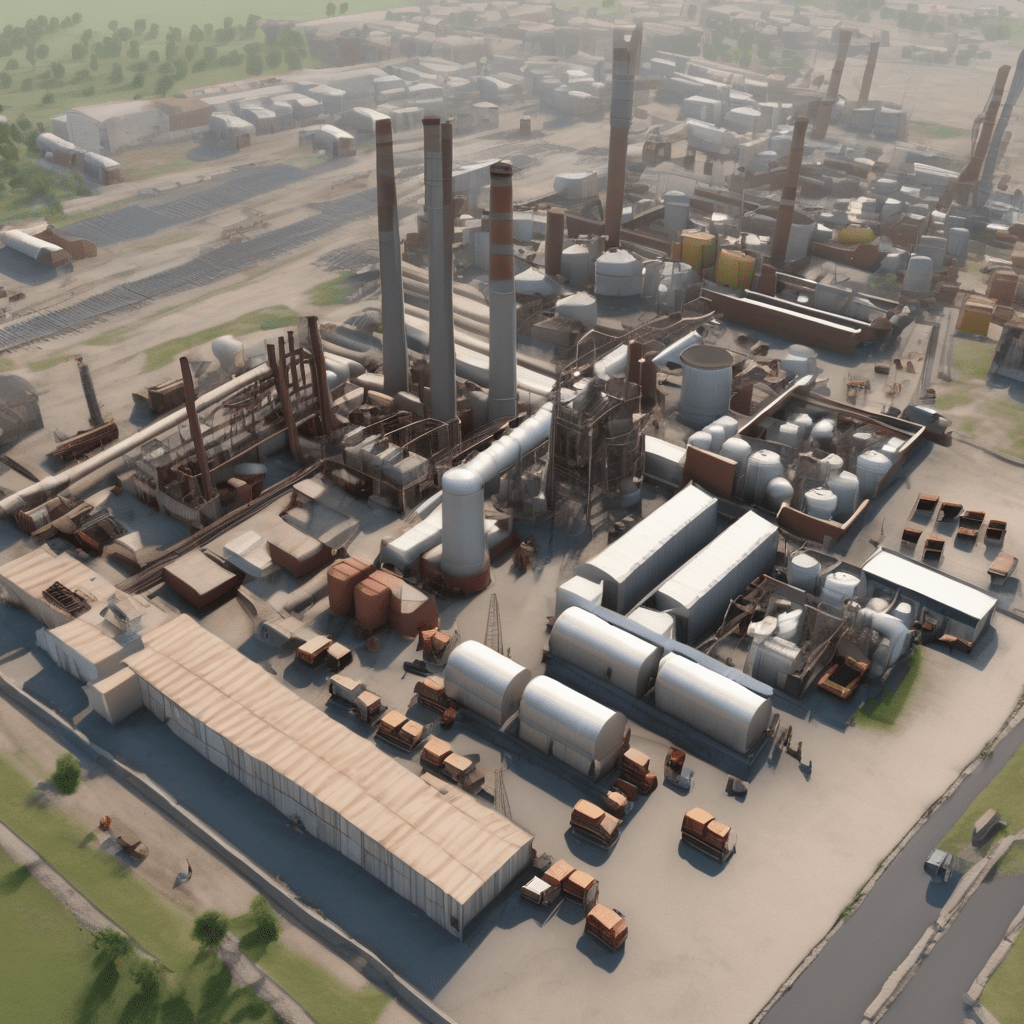

Introduction to Pakistan’s Industrial Sector:

Pakistan’s industrial sector has made tremendous strides in development over the past few decades. Once dominated by textiles, the country’s industrial base is now more diverse and advanced. Additionally, this comprehensive guide will explore the history and current state of industrial sector, highlighting key industries driving growth. Moreover, it will provide practical tips for businesses looking to invest or expand within the thriving manufacturing landscape.

From Textiles to Diversification

Pakistan’s industrial sector originated in the 1950s with a strong focus on textiles. The country’s long-standing tradition of weaving and the availability of raw materials like cotton made textiles an obvious starting point. By the 1960s, textiles accounted for over 50% of manufacturing output and fueled steady economic growth for decades. However, this also made Pakistan vulnerable if global cotton prices fluctuated. Recognizing the need for diversification, the government introduced policies in the 1980s and 90s incentivizing investment in areas like chemicals, cement, food processing, automobiles, electronics and engineering goods. This paid off, as textiles’ contribution fell to less than half of total manufacturing by the 2000s.

Key Industries Powering Growth Today

Textiles remain a pillar at approximately $20 billion annually; however, many new industries are now vital drivers of Pakistan’s industrial sector:

Cement

With massive infrastructure projects underway and a booming construction sector, cement demand has skyrocketed. Pakistan currently has ~80 cement plants and production exceeded 50 million tons in 2021, making it the 5th largest globally. Local giants like Lucky Cement and D.G. Khan Cement are expanding rapidly to meet rising local and export demand.

Automotive

The surging automotive industry in Pakistan has yielded remarkable socioeconomic benefits. Considerably, car sales have more than doubled in the past five years alone. Consequently, major vehicle manufacturers such as Indus Motors, Honda Atlas, and Packages Limited are now collectively producing over two-hundred and fifty thousand automobiles annually. This level of output has been made possible through strategic corporate investments totaling in excess of one billion US dollars.

Correspondingly, motor vehicles and their components contribute an estimated two percent to the overall gross domestic product. Additionally, the sector is bolstered by a robust network of ancillary industries involved in automotive parts manufacturing. What’s more, employment opportunities and skilled jobs have proliferated alongside the exponential expansion of the automotive assembly operations. Undoubtedly, the flourishing industry has significantly stimulated broader economic activity and development across multiple interlinked business domains.

Food Processing

As Pakistan’s population grows and incomes rise, processed food consumption is increasing dramatically. Furthermore, major players like Engro Foods, Shezan, and Mitchel’s Fruit Farms dominate categories such as juices, dairy, snacks, and frozen foods. Additionally, export potential is enormous, with the industry valued at over $30 billion.

Investment Friendly Environment

Pakistan offers strategic location, a large domestic market, and government incentives to attract manufacturing investment. Key strengths include:

- Young population of 220 million with growing middle class

- Industrial zones with world-class infrastructure

- Export processing zones with tax breaks and customs duty exemption

- Low corporate tax rates of 29%

- Duty-free access to major markets like the EU and US through trade deals

- Skilled, English-speaking workforce at competitive wages

Tips for Businesses Expanding in Pakistan

For companies wanting to take advantage of Pakistan’s industrial potential, here are some actionable tips:

- Partner with a local manufacturer that has experience navigating regulations and supply chains. Joint ventures allow rapid market entry while mitigating risk.

- Target consumer sectors like food, beverages, healthcare which have exponential growth potential as lifestyles change rapidly.

- Consider outsourcing components, spare parts, machinery parts from existing automotive and engineering supplier clusters across the country to reduce import costs.

- Focus on products in categories like household appliances, sanitary goods, electronics where Pakistan still imports the majority to tap into unsatisfied demand.

- Conduct market research trips to meet buyers, see facilities, assess infrastructure in target cities like Karachi, Lahore, Faisalabad before making large investments.

- Consider exports of intermediate or final products to take advantage of Pakistan’s numerous free trade agreements spanning regions like Asia, Gulf, Europe, North America.

Conclusion

Pakistan offers compelling rewards for manufacturers willing to navigate some initial challenges. With ambitious industrialization goals, economic reforms, and a growing labor force, the future of Pakistan’s diverse and vibrant industrial sector looks bright. Engaging local partners, leveraging regional export hubs, and focusing on high-potential consumer markets can help businesses succeed in the country’s dynamic industrial landscape.