Introduction:

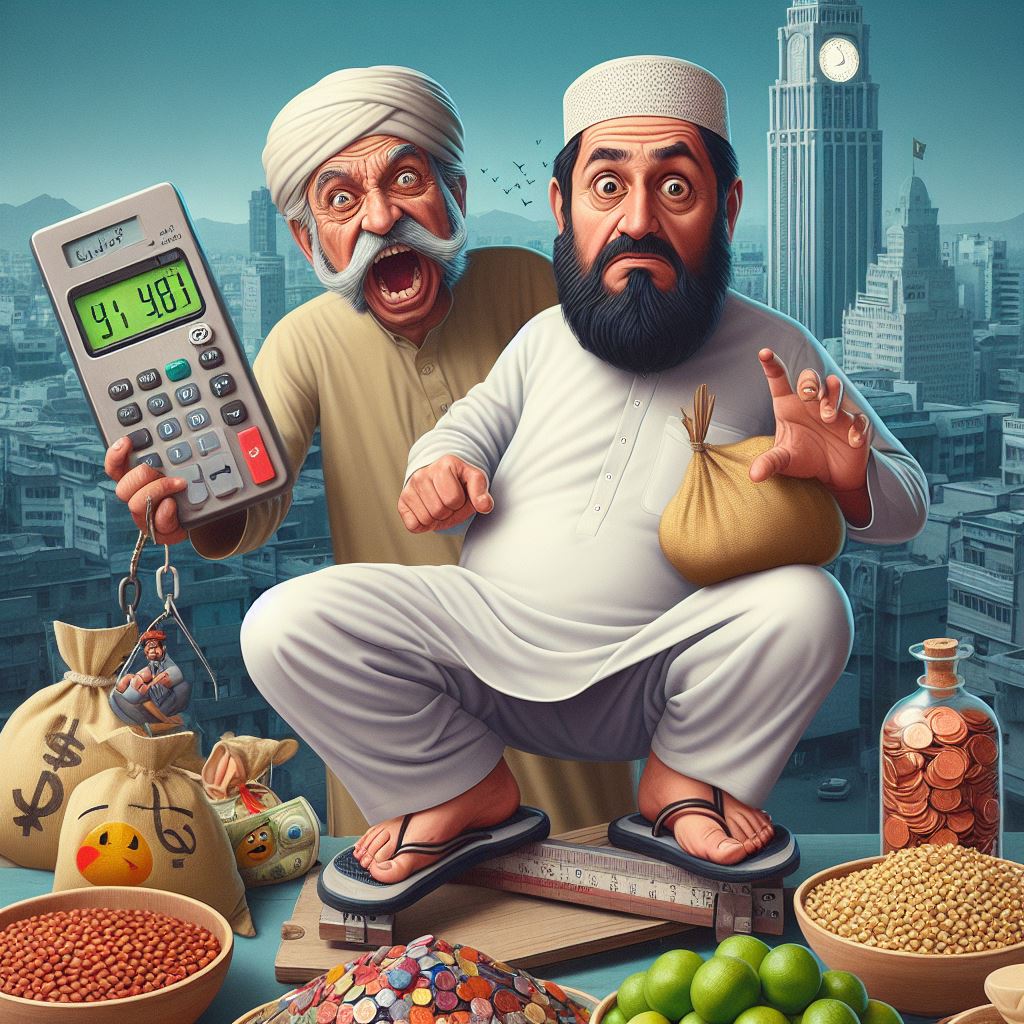

In the bustling streets of Pakistan, where the aroma of spicy cuisine mingles with the cacophony of vendors and shoppers, there lies a silent force that affects every household: inflation. Pakistan’s inflation rate, like a stealthy predator, lurks in the shadows, often unnoticed until it strikes at the heart of the common man’s purchasing power. In this blog, we’ll delve into the intricacies of Pakistan’s inflation, exploring its causes, effects, and potential solutions while maintaining a level eight grammatical standard.

Understanding Pakistan’s Inflation:

At its core, inflation refers to the sustained increase in the general price level of goods and services over a period. In Pakistan, inflation is not merely a statistical figure but a daily reality that shapes the lives of millions. From the price of essential commodities to the cost of education and healthcare, inflation seeps into every facet of life, leaving its mark on both urban centers and rural communities.

Causes of Inflation:

To comprehend Pakistan’s inflation, one must navigate through a labyrinth of economic factors. High government borrowing, excessive money supply, global commodity prices, and supply chain disruptions are among the key drivers of inflation in the country[^1^]. Additionally, geopolitical tensions, natural disasters, and political instability can further exacerbate inflationary pressures, creating a complex web of challenges for policymakers and citizens alike.

Effects on Everyday Life:

For the average Pakistani family, inflation translates into tough choices and tightening budgets. The rising cost of groceries means sacrificing nutritional quality, while skyrocketing utility bills force households to limit their consumption of electricity and gas. Furthermore, inflation erodes the value of savings, making it harder for individuals to plan for the future or invest in education and healthcare.

Navigating Economic Uncertainty:

In the face of inflationary challenges, Pakistani businesses must adapt to survive. From small-scale enterprises to large corporations, the ability to manage costs, innovate, and diversify becomes paramount in maintaining competitiveness. Moreover, prudent financial management and risk mitigation strategies are essential for safeguarding against the volatility brought about by inflation.

Government Initiatives and Policy Responses:

Governments play a pivotal role in mitigating inflation and its adverse effects on society. In Pakistan, policymakers have implemented various measures, including monetary policy adjustments, fiscal reforms, and targeted subsidies, to address inflationary pressures[^2^]. Additionally, investments in infrastructure, agriculture, and human capital development are crucial for fostering long-term economic stability and reducing reliance on imported goods.

The Role of Education and Awareness:

Amidst the complexities of inflation, education emerges as a powerful tool for empowerment. By fostering financial literacy and economic awareness, individuals can make informed decisions to navigate the challenges posed by inflation more effectively. Moreover, public discourse and civic engagement play a vital role in holding policymakers accountable and advocating for inclusive economic policies that prioritize the needs of all citizens.

Conclusion:

As the sun sets over the bustling streets of Pakistan, the struggle against inflation continues unabated. Yet, amidst the economic uncertainties and challenges, there lies a glimmer of hope—a collective resilience that transcends borders and unites communities. By understanding the root causes of inflation, fostering dialogue, and embracing innovative solutions, Pakistan can chart a path towards a more prosperous and equitable future for all.

Through the lens of human experience, Pakistan’s inflation rate ceases to be just a statistic—it becomes a narrative of resilience, adaptation, and hope in the face of adversity.

Links:

- World Bank – Pakistan: Access comprehensive reports and data on Pakistan’s economic indicators.

- State Bank of Pakistan: Stay informed about monetary policy and financial stability initiatives in Pakistan.